Celebrating 20+ Years of Excellence.

All Reverse Mortgage, Inc. is a HUD-approved HECM lender with over 20 years of experience.

We hold an A+ rating with the Better Business Bureau and maintain one of the highest review scores in the nation — a reflection of our commitment to transparency, service, and borrower peace of mind.

Reverse Mortgage Rate Comparison

Verified HUD Data from Top 20 HECM Lenders

Based on HUD FHA case endorsement data from Sept. 1, 2024 – Aug. 31, 2025. Rates shown reflect average note rate at endorsement, not a rate quote. Actual borrower rates vary and may change without notice. Report compiled Oct. 13, 2025.

HUD data source: https://entp.hud.gov/sfnw/public/ Top 20 lender list: https://www.rminsight.net/wp-content/uploads/2025/10/Lenders_202509.pdf (Access this data file here.)

Instant ARLO™ Quote

Eligibility, Real Interest Rates, APR, and Closing Costs

Most reverse mortgage calculators give rough estimates. They often leave out important details like actual interest rates, APR, and local closing costs.

That may be fine for a quick glance, but when you are evaluating a long-term financial decision, you deserve accurate, lender-backed numbers you can rely on.

ARLO™ is built different. It uses live HUD lending limits, daily rate data, and ZIP-code-specific closing costs to show you exactly what your options look like, before you ever speak with anyone.

Here’s what you’ll see instantly:

- Your maximum available loan amount based on age, home value, and 2026 HUD limits

- Real-time interest rates and APR for fixed and adjustable options

- Accurate closing costs based on your property location

- Side-by-side comparisons of payout options, including lump sum, monthly income, or line of credit

- Automatic matching for FHA-insured HECM loans and high-value proprietary options

- A year-by-year view showing how your loan balance and remaining equity may change over time

Why 2026 Is an Important Year to Revisit Your Options

HUD has announced a record-high reverse mortgage lending limit of $1,249,125 for 2026, effective January 1. That is a nearly $40,000 increase over last year’s limit, which means many homeowners may now qualify for more available equity than they did before.

At the same time, interest rates have begun to trend lower from recent highs. When higher lending limits and improving rates align, it creates an opportunity worth reviewing, even if you previously considered a reverse mortgage and decided to wait.

If you were previously just short of qualifying, or your numbers did not quite make sense, this change alone could materially improve your results!

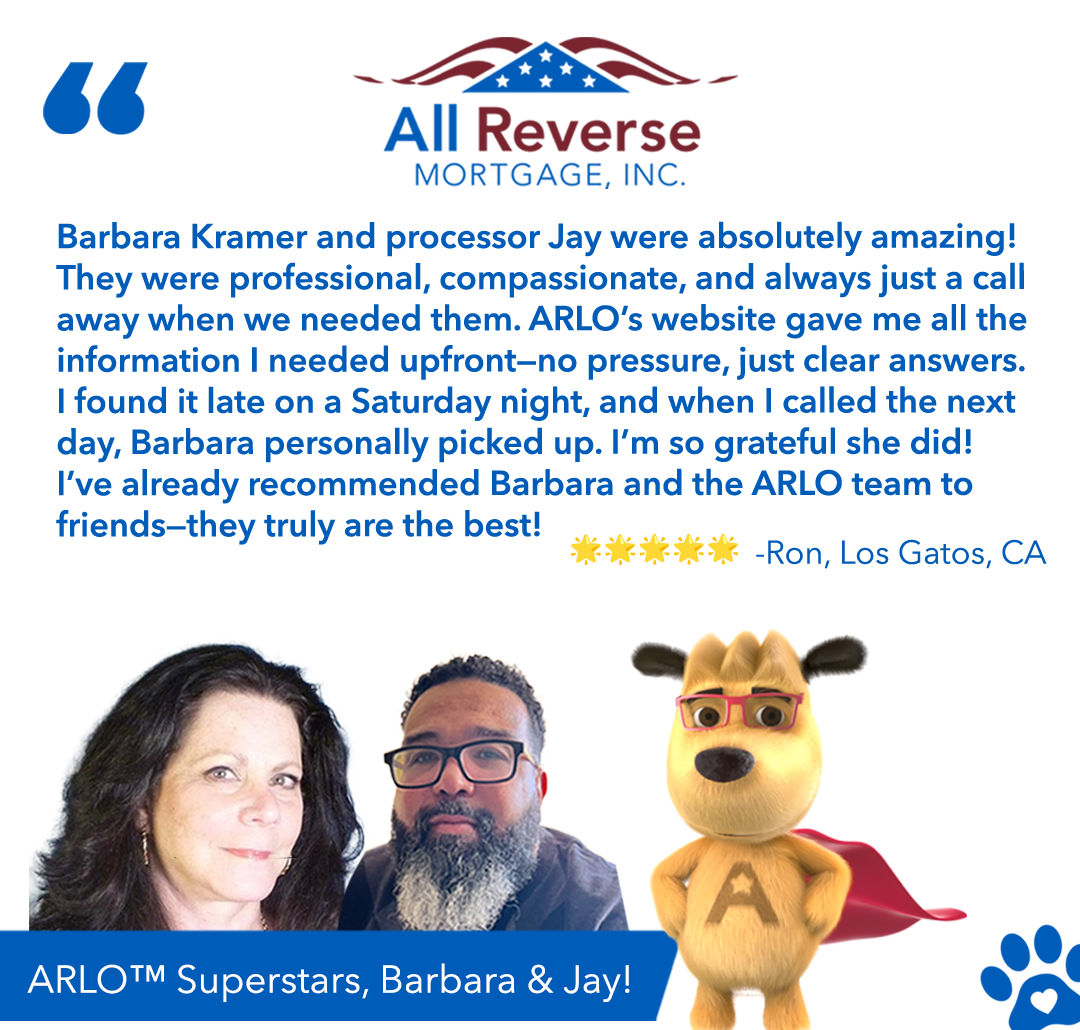

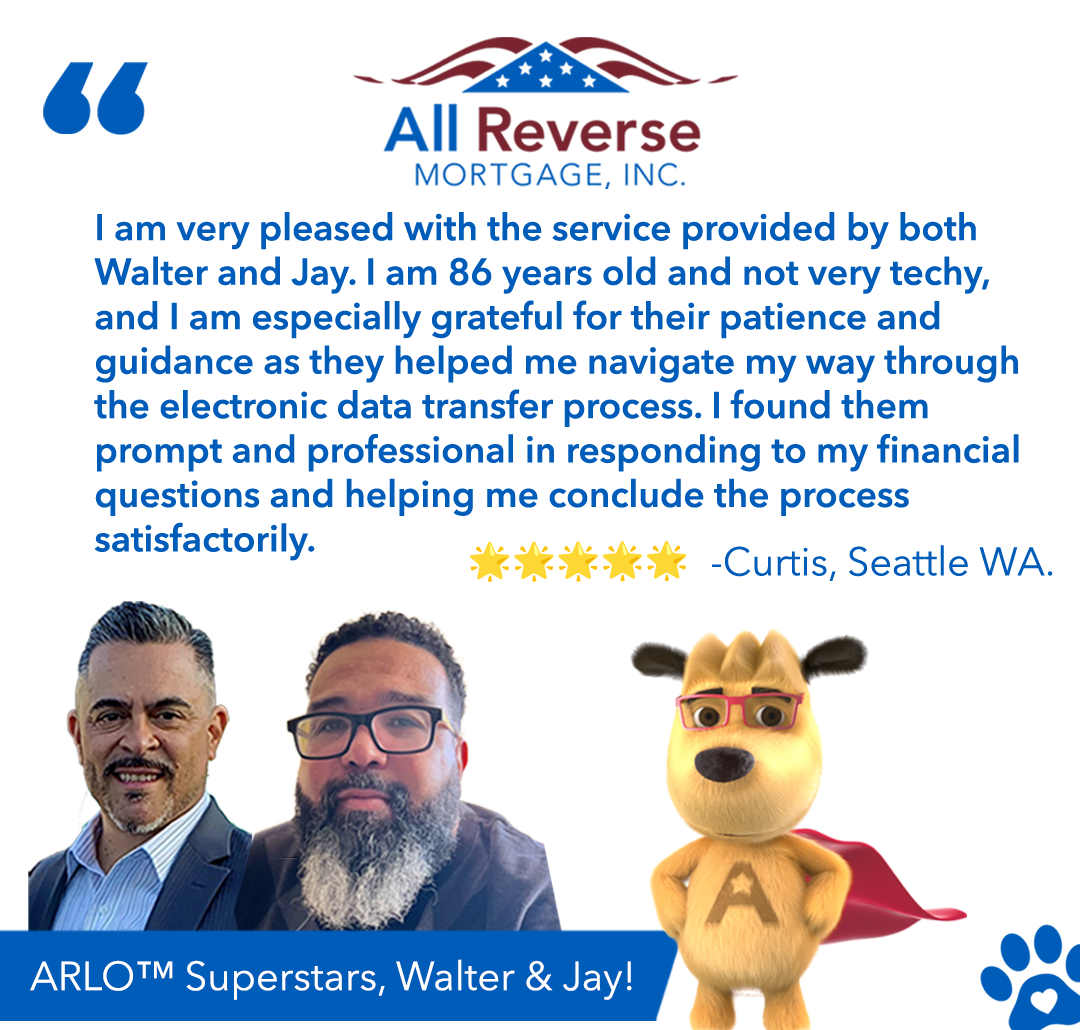

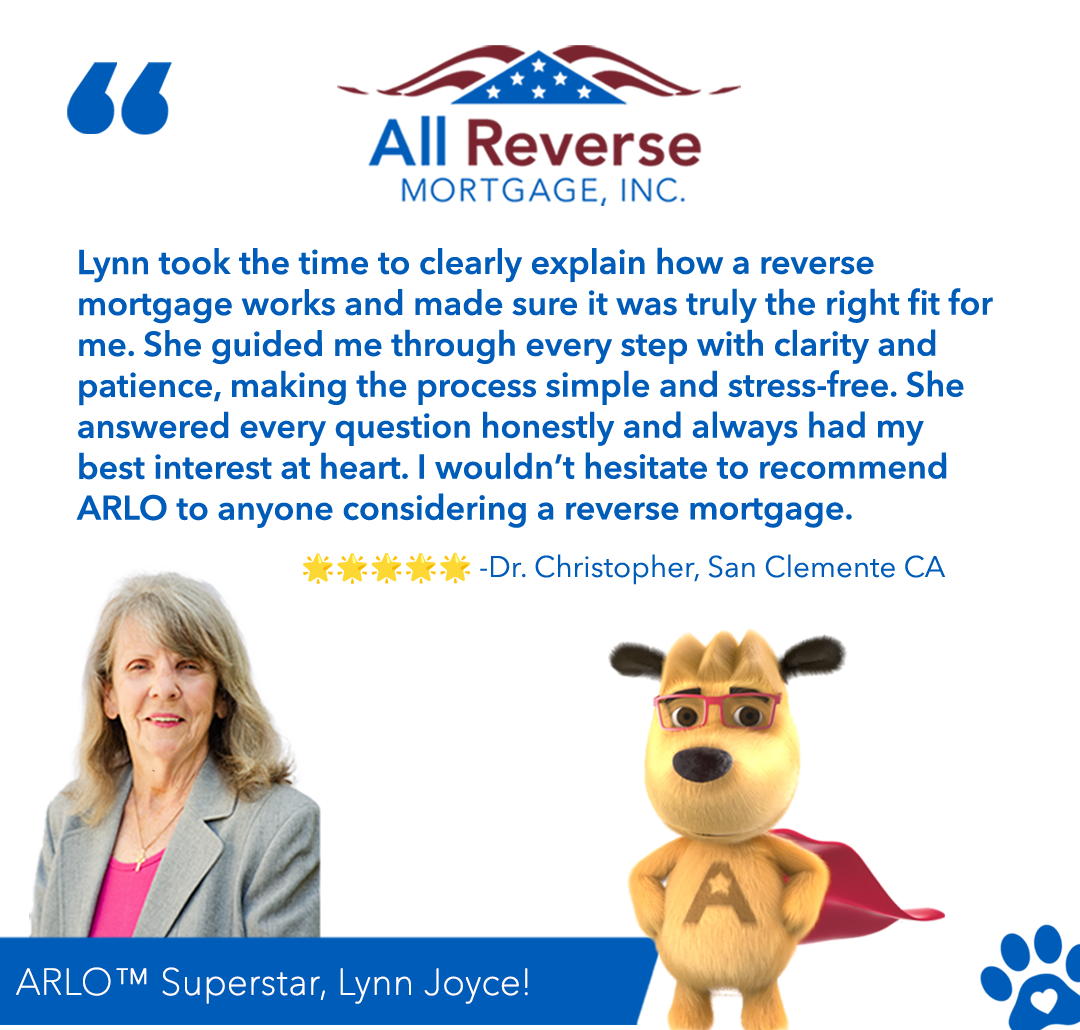

What Our Customers Say

The stories shared by our customers reflect our commitment to delivering clear guidance, excellent service, and lasting peace of mind throughout the reverse mortgage process.

A+ Rated Accredited Business (4.99/5 Stars)

-Better Business Bureau

Back to Back Torch Ethics Finalists 2021 & 2022

-Better Business Bureau

Rated #1 Reverse Mortgage Company of 2024

-Caring.com

4.9/5 Star Rating from Google

-Google My Business

Cited by Professor Jack Guttentag (The Mortgage Professor)

For presenting clear, accessible pricing without requiring personal information, as reported by HousingWire.

© 2026 All Reverse Mortgage, Inc. All Rights Reserved. NMLS #13999 HUD Lender #26031-0007 Privacy Policy

This material has not been reviewed, approved, or issued by HUD, FHA, or any government agency. All Reverse Mortgage, Inc. is an independent company and is not affiliated with, acting on behalf of, or endorsed by HUD/FHA or any government agency. This content is for educational purposes and is not tax advice. Reverse mortgage programs may not be available in all states.